Theresa Lorsch

12. February 2024

Checklist for company car drivers: charging electric company cars at home

Requirements for easy charging and billing

More than two thirds of all cars in Germany are business registrations. In 2022, with an average electrification rate of 15 percent, around one in seven registrations in a company fleet was an electric or hybrid vehicle. As the number of electric company cars increases, so does the need for charging facilities at employees' homes to allow easy and independent charging. But what do company car drivers need to bear in mind in this context? In our checklist, we have summarized the most important things to consider.

1. Charging infrastructure: check electrical installation at home

If a charging station is to be installed at an employee's home, certain requirements must be met, and technical building precautions must be taken. In addition to the registration or approval of the charging station by the grid operator, this includes, among other things, the inspection of the power distribution box and the general electrical installation of the building by a qualified electrician. The steps to take may also vary depending on the type of housing (e.g. installation in a detached house versus rented apartment). For example, tenants with their own parking space who live in an apartment building must inform their landlord and the property management about the installation of a charging station and initiate the necessary steps.

2. Purchase and installation: clarify who will cover the costs

There is currently no regulation in Germany that obliges the employer to cover the purchase and installation costs of a charging station for an employee. If a company car driver is interested in charging his EV car at home, it is advisable to seek a conversation with the employer. The financing options offered by the employer can range from partial to full financing. Both parties can benefit from tax advantages.

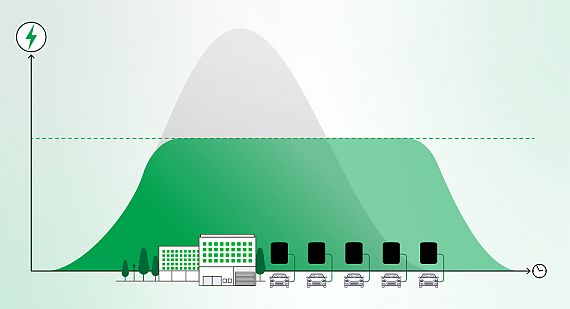

3. EV charger with backend: invest in smart charging infrastructure

Charging a company car at home should be quick and easy. It therefore makes sense to look for a charging station that is equipped for communicating with a backend. A backend solution automatically credits company car drivers for the electricity charged at home as part of payroll accounting. Moreover, charging sessions can often be monitored transparently by employees in an online portal. This makes administration easier for everyone involved.

You can easily check which backend solutions ABL charging stations are compatible with on our overview page.

4. Billing of charging processes at home: select the appropriate billing method

If a company car is also used privately and charged at home, there are basically two options for billing. In Germany, the billing of charging processes is regulated by the German Income Tax Act (§ 3 Nr. 46 EstG).

- Tax-free monthly lump sum: The amount of the monthly flat rate depends on whether the company has charging infrastructure and whether the company car is a purely electric vehicle or a plug-in hybrid.

- Billing to the exact kilowatt hour: Company car drivers receive a tax-free credit for the charging costs. The financial reimbursement corresponds to the exact kilowatt-hour electricity consumption. With this type of billing, it must be ensured that business charging processes at home can be clearly separated from private charging processes (e.g. by means of a MID-compliant meter). In this context, automated billing via a backend is a practical solution.

5. State subsidies: check financial benefits

If you are allowed to use your company car privately, you must pay tax on this as a non-cash benefit with your income. If you as an employee are registered as the owner in the registration certificate, you can benefit from GHG quota income.

Submit comment

Relevant articles

YTo0OntpOjA7aTo0NjYyO2k6MTtpOjUyMTY7aToyO2k6NTE5OTtpOjM7aTo1MTgwO30=

94

czoyOiIzNSI7